US DOE releases national clean hydrogen strategy and roadmap

Green Car Congress

JUNE 6, 2023

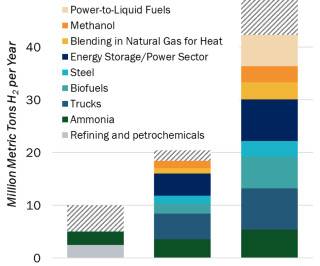

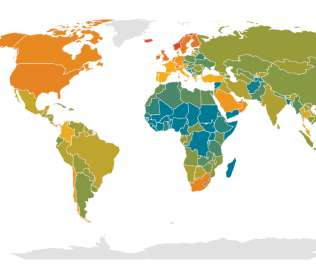

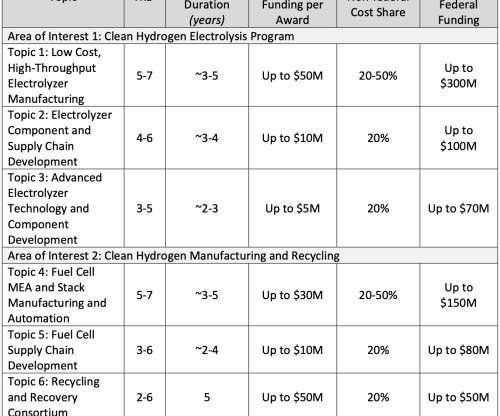

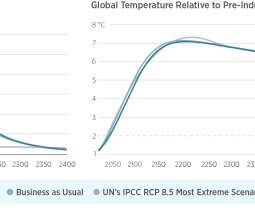

The US Department of Energy (DOE) released the US National Clean Hydrogen Strategy and Roadmap , a framework for accelerating the production, processing, delivery, storage, and use of clean hydrogen. Source: DOE. It also complements the massive $9.5-billion It also complements the massive $9.5-billion

Let's personalize your content