Optimizing Car Leasing Tax Advantages

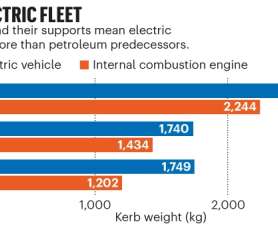

Clean Fleet Report

OCTOBER 22, 2023

Optimizing Car Leasing Tax Advantages The UK Business Benefits This article may contain affiliate links. One strategy that’s gaining popularity among UK businesses is leasing, particularly when it comes to cars. Tax Benefits Now, let’s delve into the tax benefits of leasing a car for your business.

Let's personalize your content