Battery-grade lithium carbonate forecast to trade at $74K/tonne in 12 months

Green Car Congress

AUGUST 21, 2022

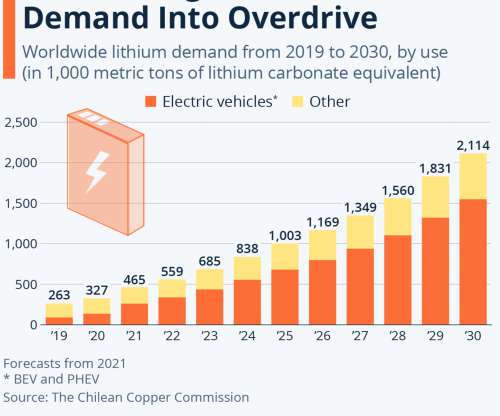

Trading Economics global macro models and analysts expectations forecast battery-grade lithium carbonate to trade at 504,813 CNY (US$74,000) per tonne in 12 months time. Lithium is expected to trade at 484,185.00 by the end of this quarter. Earlier post.). Lithium carbonate is forecast to trade near its high.

Let's personalize your content