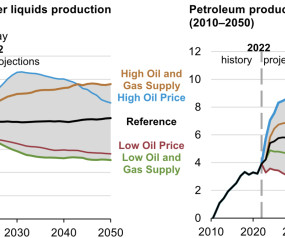

EIA: International demand will drive US production of petroleum and other liquids through 2050

Green Car Congress

APRIL 5, 2023

Strong continuing international demand for petroleum and other liquids will sustain US production above 2022 levels through 2050, according to most of the cases in the US Energy Information Administration’s (EIA’s) Annual Energy Outlook 2023 (AEO2023). These cases include: The Reference case, which serves as a baseline, or benchmark, case.

Let's personalize your content