Putting the “Utility” in Sport Utility Vehicle: Which Electric SUVs Perform Best Off-Road?

EV Life

DECEMBER 12, 2023

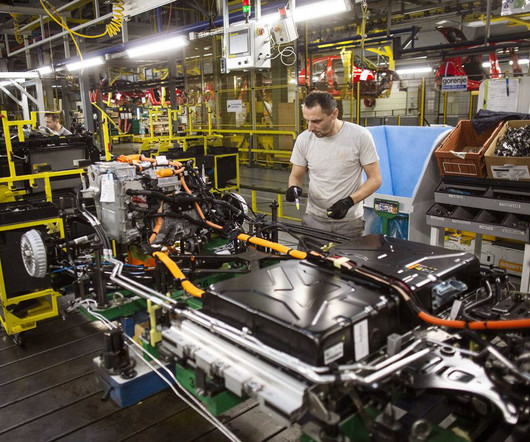

These combination car-and-SUVs have become immensely popular for a variety of reasons. The second reason EV crossovers are so popular with automakers is the vehicle classification standards put forth by the Treasury Department to determine whether a vehicle is a car, SUV, truck, or van. Where Are All the True SUVs?

Let's personalize your content