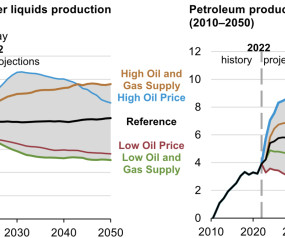

EIA: International demand will drive US production of petroleum and other liquids through 2050

Green Car Congress

APRIL 5, 2023

EIA projects that the United States will continue to be an integral part of global oil markets and a significant source of supply in these cases, as increased exports of finished products support US production. It reflects laws and regulations adopted through mid-November 2022 but assumes no new laws or regulations in the future.

Let's personalize your content