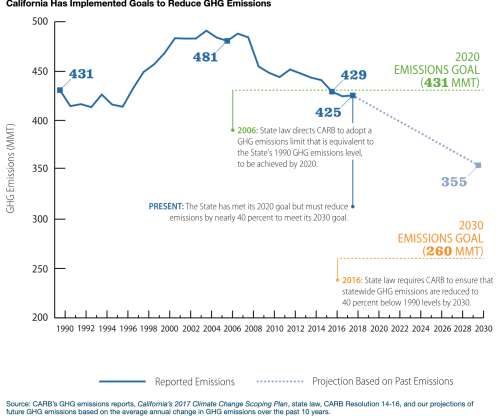

Report finds says “negative emissions technologies” need to play a large role in mitigating climate change

Green Car Congress

OCTOBER 29, 2018

To achieve goals for climate and economic growth, “negative emissions technologies” (NETs) that remove and sequester carbon dioxide from the air will need to play a significant role in mitigating climate change, according to a new report from the National Academies of Sciences, Engineering, and Medicine.

Let's personalize your content