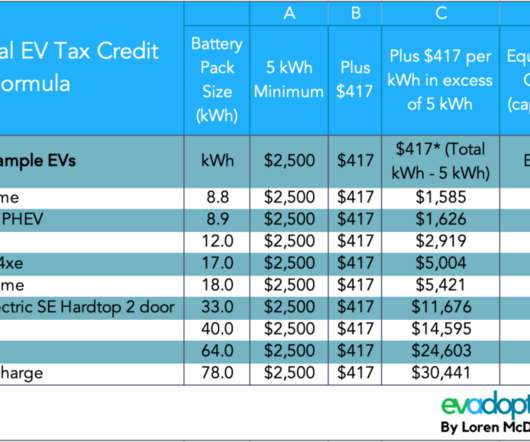

Senate Finance Committee Approves $12,500 EV Tax Credit Bill

The Truth About Cars

MAY 27, 2021

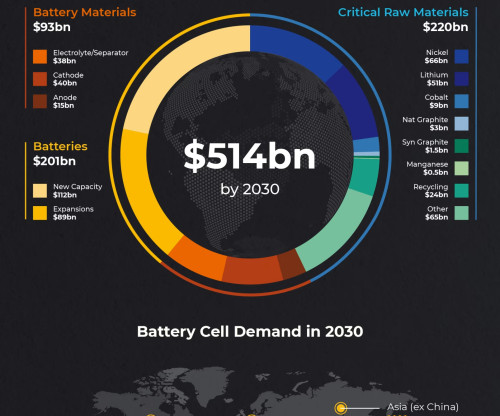

On Wednesday, the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. Changes include raising the federal EV tax rebate ceiling to $12,500 and opening the door for automakers who already exhausted their production quotas.

Let's personalize your content