IRS seeks feedback on clean hydrogen production tax credit

Green Car Congress

NOVEMBER 7, 2022

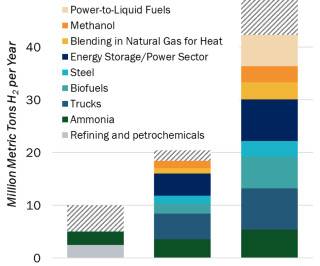

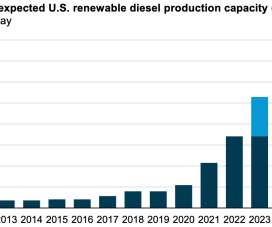

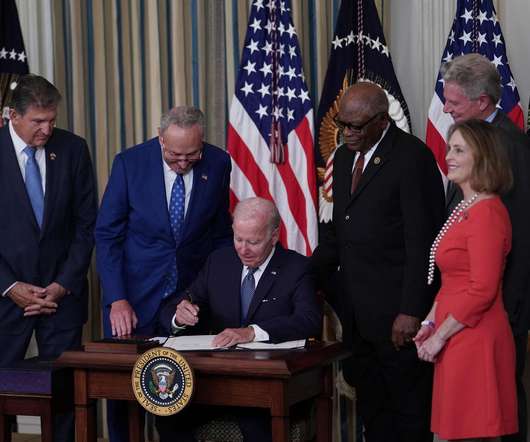

The US Department of the Treasury and the Internal Revenue Service (IRS) have released three notices requesting public input on several tax credit provisions in the Inflation Reduction Act (IRA). These include: Credits for Clean Hydrogen Production (45V) and Clean Fuel Production (45Z) ( Notice 2022-58 ).

Let's personalize your content