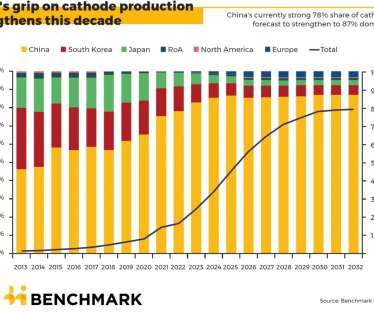

Benchmark Mineral Intelligence: lithium industry needs $42B investment to meet 2030 demand

Green Car Congress

MAY 14, 2022

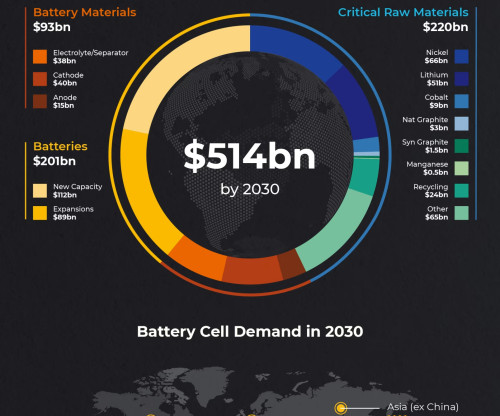

The lithium industry needs $42 billion of investment if it is to meet 2030 demand, according to analysis by Benchmark Mineral Intelligence. This works out at approximately $7 billion a year between now and 2028 if the industry is to meet lithium demand by the end of the decade. Lithium Carbonate, EXW China, ?99.0%

Let's personalize your content