The Next Oil Price Spike May Cripple The Industry

Green Car Congress

AUGUST 25, 2017

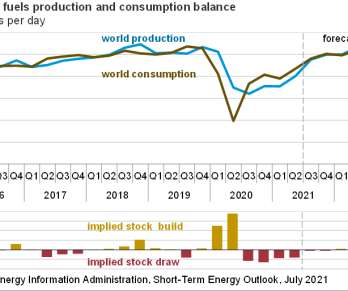

Two diametrically opposed views dominate the current debate about where the oil price is heading. Why the price of oil could spike before that. That leaves the period until the end of the 2020s, during which we believe overall oil demand will continue to grow (albeit slower than before). Since (non-U.S.

Let's personalize your content