Zero EVs May Qualify For the Federal Tax Credit Under the Inflation Reduction Act Requirements

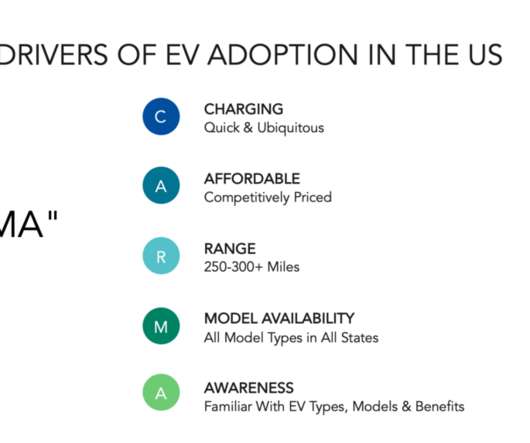

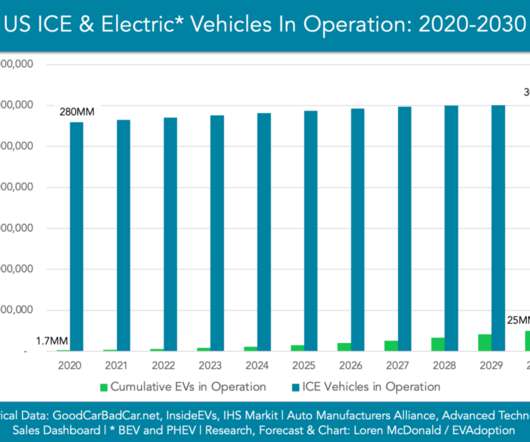

EV Adoption

AUGUST 4, 2022

Additionally, the IRA could actually receive enough votes to pass, but not without potentially several significant changes — including to some of the EV tax credit requirements. This means EVs like the Mustang Mach-E which is assembled in Mexico, and the Chrysler Pacifica Hybrid (PHEV) which is assembled in Canada, would qualify.

Let's personalize your content