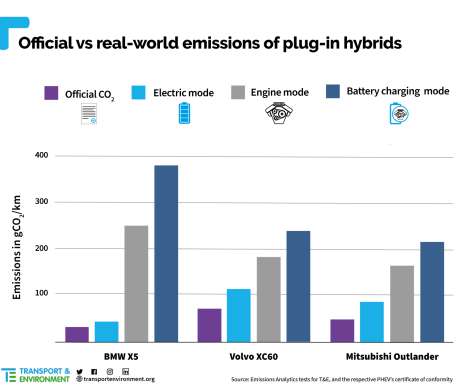

T&E study finds plug-in hybrids show higher CO2 emissions than claimed

Green Car Congress

NOVEMBER 24, 2020

Three of the most popular plug-in hybrids in 2020 all emitted more CO 2 than advertised when tested in the real world, according to tests commissioned by European environmental NGO Transport & Environment (T&E). T&E said governments should therefore end the purchase subsidies and tax breaks for plug-in hybrids.

Let's personalize your content