Jeep plug-in pickup, Acura ZDX, Cadillac’s EV shift, tax credit rules: Today’s Car News

Baua Electric

MAY 3, 2024

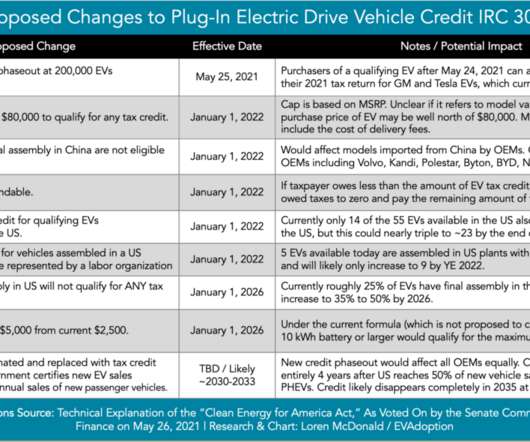

A plug-in hybrid Gladiator will join the Jeep lineup next year. And Biden agencies ease one area of the EV tax credit that could mean more qualifying EVs. Jeep announced Thursday that a plug-in hybrid version of its Wrangler-based Gladiator pickup will arrive “later next year.” This and more, here at Green Car Reports.

Let's personalize your content