Analysis finds annual running cost of EVs less than ICE; but with purchase price factored in, it flips

Green Car Congress

OCTOBER 9, 2020

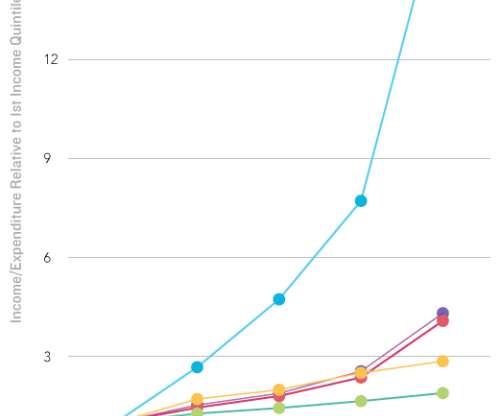

Self Financial, a fintech company, has compared the running costs of electric and non-electric vehicles in each state. Across the US the average annual cost of running an electric vehicle is $2,721.96, while gasoline vehicles cost an average of $3,355.90 per year to run—a difference of $633.94

Let's personalize your content