Roskill: Niobium industry looking for a future beyond steel; Li-ion batteries a possibility

Green Car Congress

FEBRUARY 17, 2020

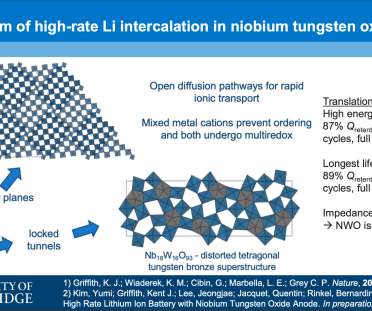

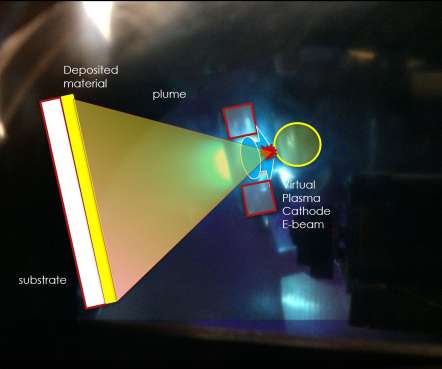

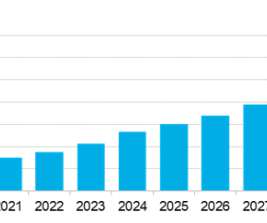

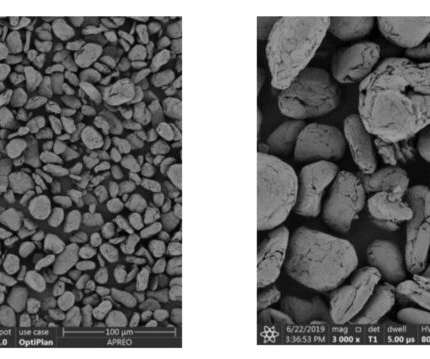

Another key characteristic of the niobium market is its highly concentrated supply. Moreover, Roskill forecasts that China’s steel production is close to its peak. The maximum power output and minimum charging time of a lithium-ion battery depend on both ionic and electronic transport. The paper (Griffith et al. )

Let's personalize your content