Senate improves EV tax credit in largest climate bill ever

Electrek

AUGUST 7, 2022

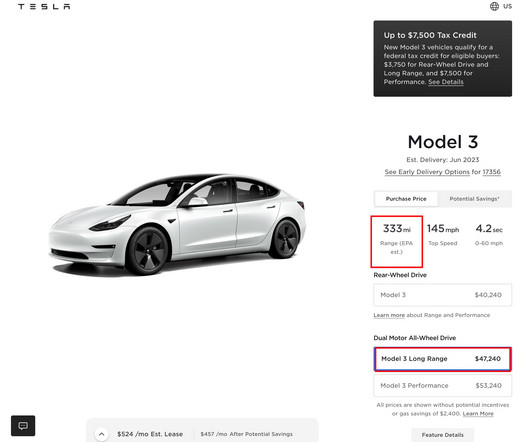

The Senate has voted to pass the Inflation Reduction Act, which includes nearly $400 billion over 10 years in funding for climate and energy related programs, and an extension and improvement of the US electric car tax credit. The post Senate improves EV tax credit in largest climate bill ever appeared first on Electrek.

Let's personalize your content