Toyota EVs and plug-in hybrids: Full $7,500 EV tax credit will likely phase out October 1

Green Car Reports

JULY 2, 2022

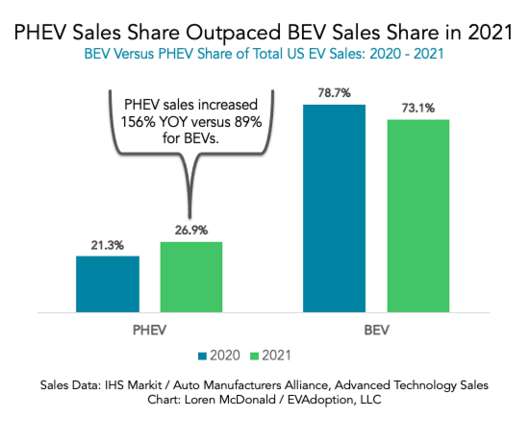

It appears that sales of Toyota’s plug-in models in recent months were enough to trigger the automaker’s phaseout period for the federal EV tax credit this past quarter—leaving buyers less than nine months to buy a vehicle like the BZ4X electric car or RAV4 Prime plug-in hybrid and be able to claim the full $7,500 amount.

Let's personalize your content