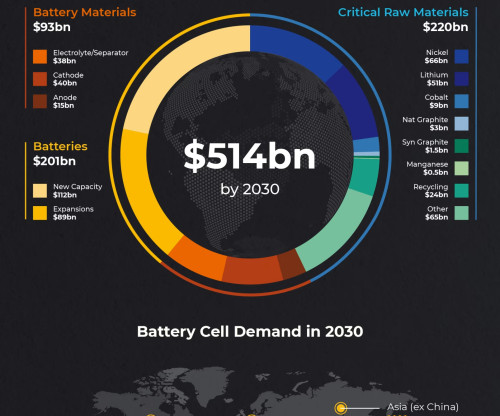

EVs with Chinese parts won’t qualify for the full $7,500 tax credit from 2024

Electrek

DECEMBER 1, 2023

The US government has released guidance that will make it harder for EVs to qualify for the full $7,500 tax credit if their batteries contain Chinese components or minerals. more… The post EVs with Chinese parts won’t qualify for the full $7,500 tax credit from 2024 appeared first on Electrek.

Let's personalize your content