US DOE releases 2023 Critical Materials Assessment to evaluate supply chain security for clean energy technologies

Green Car Congress

AUGUST 1, 2023

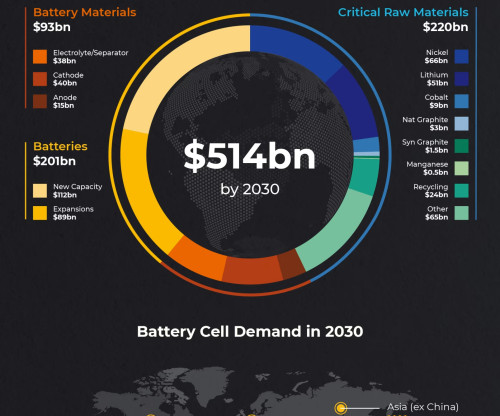

The US Department of Energy (DOE) released its 2023 Critical Materials Assessment (2023 CMA), which evaluated materials for their criticality to global clean energy technology supply chains. The Assessment focuses on key materials with high risk of supply disruption that are integral to clean energy technologies.

Let's personalize your content