EV tax credit rules get extension in big win for automakers

Teslarati

MAY 3, 2024

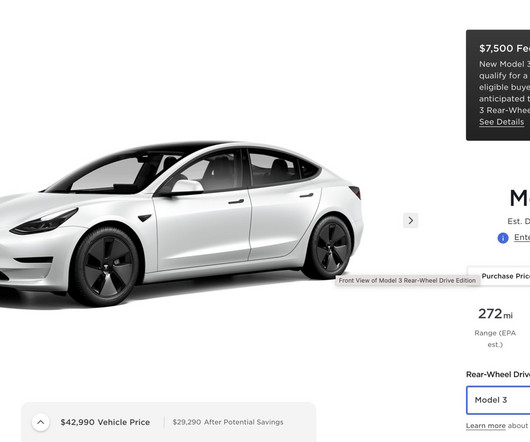

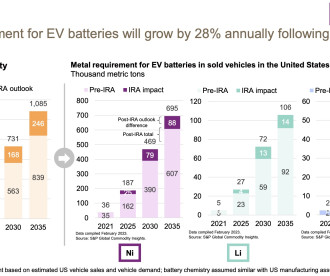

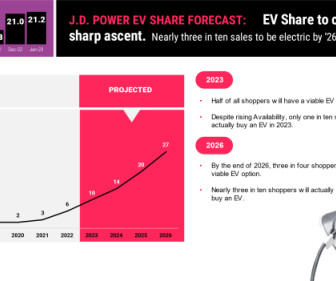

The electric vehicle tax credit rules got an extension on Friday as the U.S. Department of the Treasury will allow some crucial trace minerals from China to be included in anode materials and battery components to be exempt. The post EV tax credit rules get extension in big win for automakers appeared first on TESLARATI.

Let's personalize your content