Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout

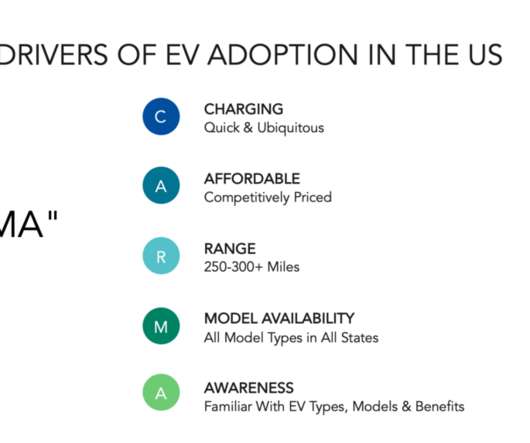

EV Adoption

AUGUST 18, 2021

Arguably the biggest flaw in the Plug-In Electric Drive Vehicle Credit ( IRC 30D ) regulations is the triggering of a phaseout schedule of the tax credit when a manufacturer sells 200,000 total EVs (BEV and PHEV). In this part 2 article, we’ll dive deeply into the elimination of the per manufacturer 200,000 EVs sold phaseout.

Let's personalize your content