DOE labs study on costs and benefits of new transportation technologies the most comprehensive to date

Green Car Congress

AUGUST 14, 2021

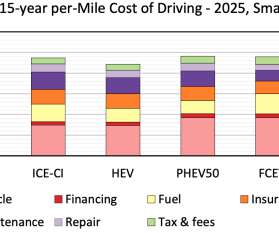

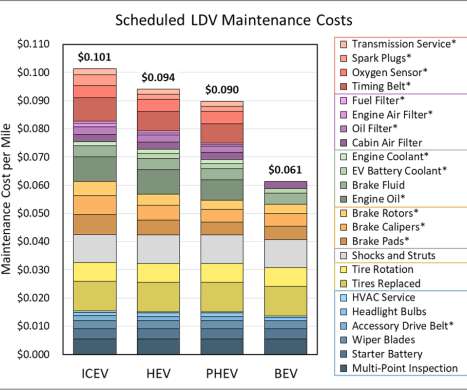

A new study published by US Department of Energy’s (DOE) Argonne National Laboratory offers the most complete understanding yet of the costs of owning and operating a vehicle, and how those costs vary by powertrain, from the conventional to the cutting-edge. Overall, hybrid electric vehicles tend to be the lowest-cost powertrain.

Let's personalize your content