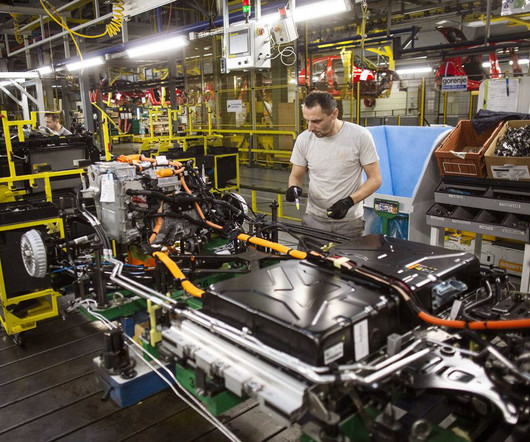

Tesla Semi will be incredibly affordable with US’ revamped EV tax credit

Teslarati

JULY 29, 2022

The bill allocates $369 billion for programs that help fight climate change and preserve the environment, and it also includes a number of revamped EV tax credits. With a $40,000 incentive, the Tesla Semi could be purchased at a price that is more affordable than a Tesla Model S and Model X Plaid without incentives.

Let's personalize your content