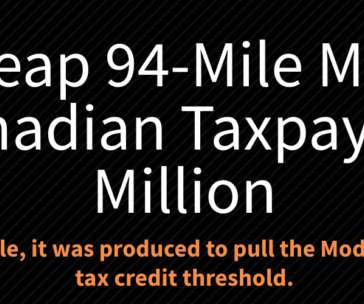

Tesla Model 3 Highland leases qualify for IRA tax credit loophole

Teslarati

JANUARY 10, 2024

The Tesla Model 3 Highland was recently launched in North America. Tesla Model 3 Highland leases are more affordable thanks to a loophole in the Inflation Reduction Act about commercial vehicles. Tesla calculated that Model 3 Highland lease payments would be $329 monthly, excluding taxes and fees.

Let's personalize your content