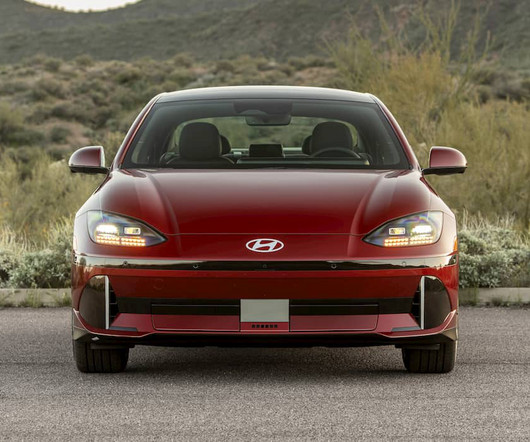

The Honda Prologue Gets Major Boost with Federal Tax Credit Eligibility

The Truth About Cars

MARCH 6, 2024

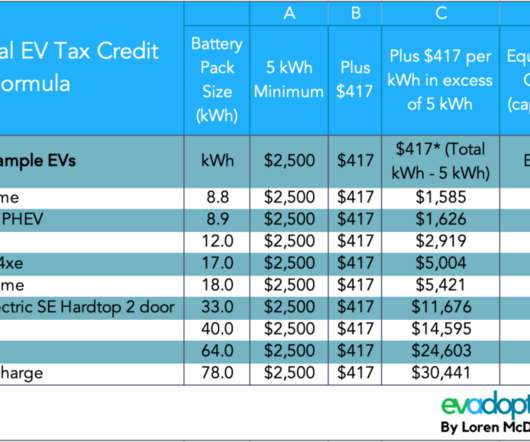

The automaker recently announced that its upcoming Prologue EV would be eligible for federal tax credits of $7,500, meaning buyers can get around 15 percent off the SUV’s purchase price at the point of sale. Tax credits bring the Prologue’s starting price down to $41,295 after a $1,395 destination charge.

Let's personalize your content