Used EV tax credit, union-built bonus part of House social and climate bill now headed to Senate

Green Car Reports

NOVEMBER 22, 2021

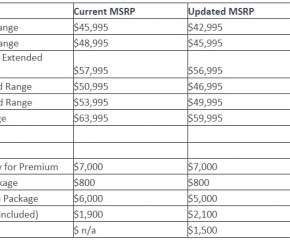

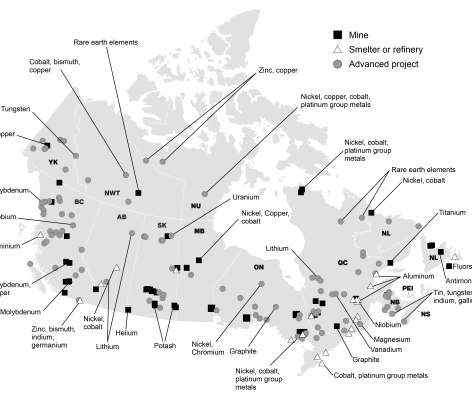

The infrastructure and social policy bills passed by the United States House of Representatives this week include many EV provisions, from investments in charging infrastructure to a rejuvenated EV tax credit. 5376) replaces the current federal EV tax credit with a new one that. Now they head to the Senate.

Let's personalize your content