How to Save Big on a Tesla with Colorado’s New EV Tax Credit

EV Life

JANUARY 11, 2024

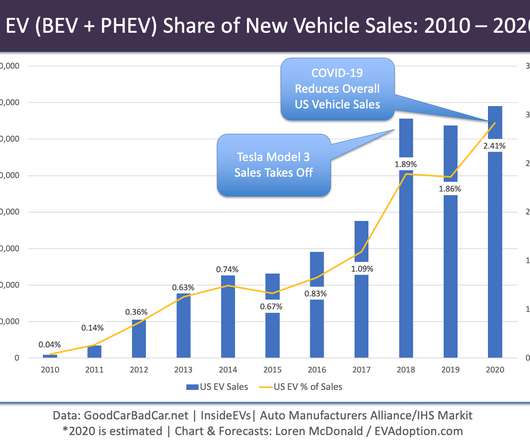

With climate change awareness increasing, gas prices continuing to climb, EV charging stations expanding, and tons of new EV options hitting the market each year, it’s no surprise that electric vehicle purchases are skyrocketing. This is great news for Tesla fans, as many Tesla models qualify for the credit.

Let's personalize your content