President Biden calls on Congress, States for fuel tax holiday; increase in refinery capacity

Green Car Congress

JUNE 23, 2022

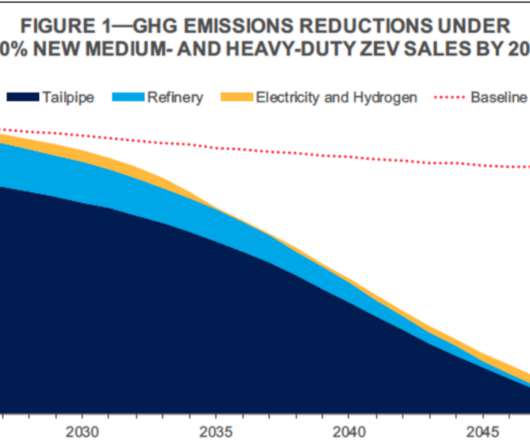

Moreover, many facilities have safely delayed projects and/or maintenance so as to not take production offline and instead continue to provide supplies and build inventories. About half of US refinery shutdowns are conversions to renewable fuel production. Other important suppliers to the US.,

Let's personalize your content