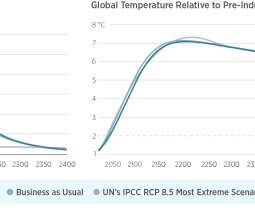

Study finds limiting warming to 2 °C would require at least a $200/t carbon tax globally

Green Car Congress

MAY 6, 2022

These heterogeneous effects mean that different countries will have differing incentives to abide by the Paris Agreement, which aims to limit global warming below 2 °C relative to pre-Industrial levels. The price of carbon should then be set at this price, everywhere. —Cruz & Rossi-Hansberg.

Let's personalize your content