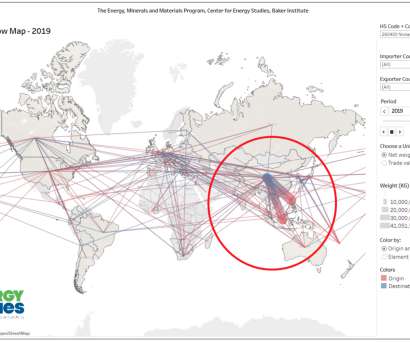

Baker Institute report: China has positioned itself as a gatekeeper to the energy transition; nickel case study

Green Car Congress

APRIL 21, 2022

While Russia holds significant leverage in influencing oil and gas prices, it pales in comparison to China’s position in several strategic industries critical to the energy transition, says report author Michelle Michot Foss, fellow in energy and materials at the Baker Institute. —Baker Institute report Need Nickel?

Let's personalize your content