Unifrax to build large-scale silicon fiber anode manufacturing line

Green Car Congress

JUNE 16, 2021

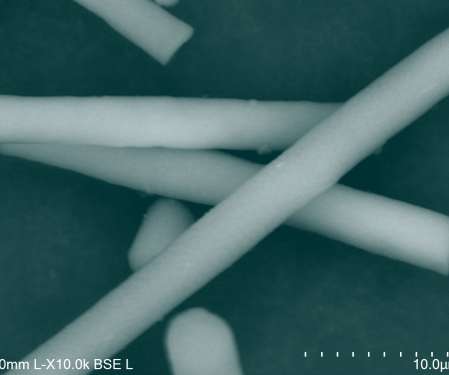

Unifrax, a global manufacturer of high-performance specialty materials, plans to build its first large-scale SiFAB (silicon fiber anode material) manufacturing line at its north central Indiana facility. SiFAB can be mixed into anode slurry with existing battery manufacturing processes. Source: Unifrax.

Let's personalize your content