Law firm Akerman launches EV infrastructure-oriented legal team – Charged EVs

Baua Electric

FEBRUARY 5, 2024

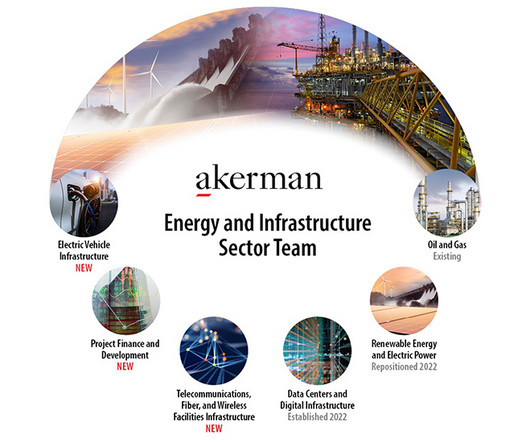

The multidisciplinary teams “build upon the existing capabilities of Akerman’s Data Centers and Digital Infrastructure Practice and Renewable Energy and Electric Power Practice to support clients’ multifaceted needs as a post-carbon 21st-century economy takes shape.”

Let's personalize your content