General Motors sidesteps loss of EV tax credit to offer big discounts for customers

Teslarati

JANUARY 3, 2024

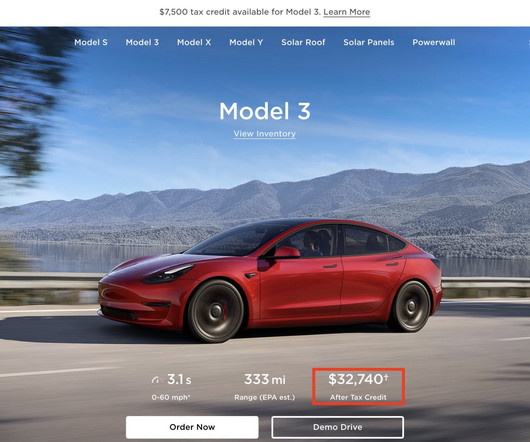

General Motors is sidestepping the loss of the electric vehicle tax credit on its vehicles and will still offer a big $7,500 discount on cars for customers. In December, GM said it would temporarily lose eligibility for the credit on some of its cars. can qualify for EV tax credits.

Let's personalize your content