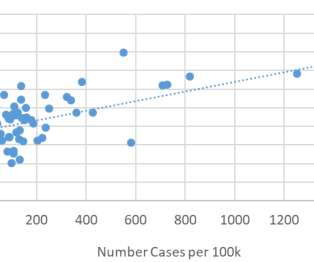

US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

New York carried the highest rate of cases during the reporting period. Drivers there and in the surrounding states of New Jersey, New York, Rhode Island, Connecticut, Massachusetts and Vermont drove at least 80% fewer miles after shelter-in-place directives began. Fuel saved, tax revenue lost. billion per week.

Let's personalize your content