BP Statistical Review finds global oil share down for 12th year in a row, coal share up to highest level since 1969; renewables at 2%

Green Car Congress

JUNE 13, 2012

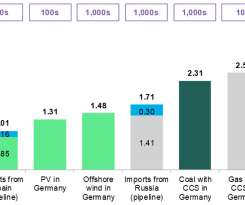

Oil remains the world’s leading fuel, but its 33.1% Coal’s market share of 30.3% Emerging economies accounted for all of the net growth, with OECD demand falling for the third time in the last four years, led by a sharp decline in Japan. in the emerging economies. in the emerging economies. Source: BP.

Let's personalize your content