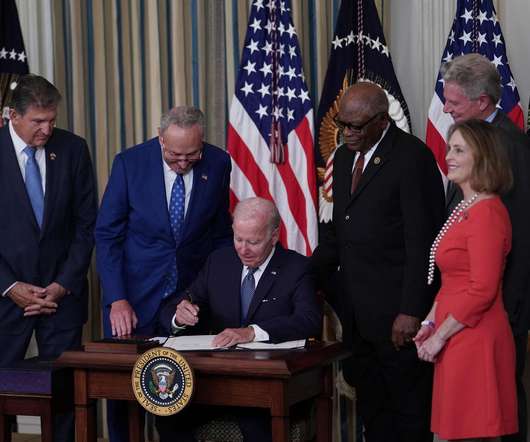

How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Blink Charging

APRIL 13, 2023

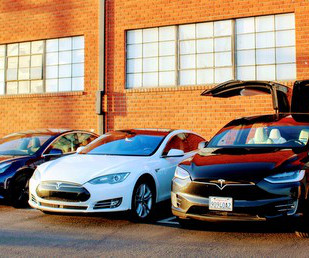

Usually when discussing federal electric vehicle tax credits in the United States , most people are referring to the Clean Vehicle Credit (formerly the Qualified Plug-in Electric Drive Motor Vehicle Credit) for new EVs. But that’s not the only federal tax credit for buying an EV.

Let's personalize your content