Tesla Model 3 Long Range Now Eligible for Full $7,500 Tax Credit — Low Cost of Ownership Now

CleanTechnica EVs

JUNE 19, 2024

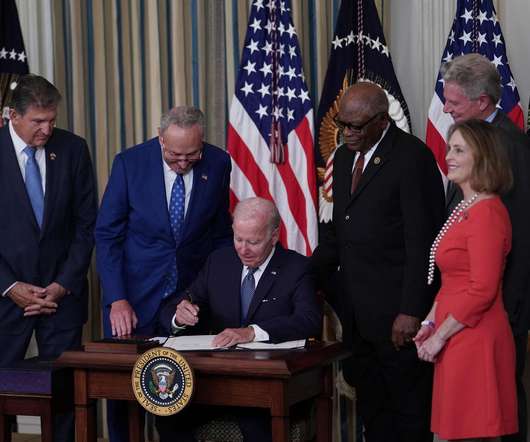

You can now buy the Tesla Model 3 Long Range in the United States and get the full $7500 federal tax credit. That is, of course, if you have that much tax liability. Consult a tax professional before counting on the full $7500 if you are not sure of your.

Let's personalize your content