IHS Markit: global oil demand still growing in the short term despite increasing focus on EVs

Green Car Congress

APRIL 23, 2018

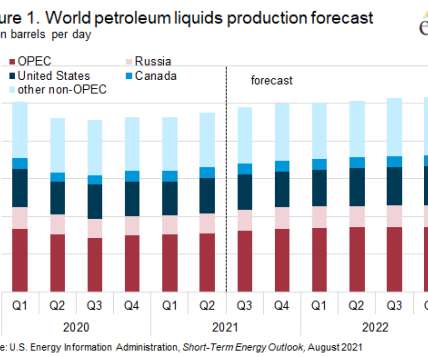

Short-term oil demand is still growing strong and will continue to do so through the end of 2020 despite the market’s increasing focus on electric vehicles and the forecasted future plateau in oil demand, according to new analysis from IHS Markit, a global business information provider. Source: IHS Markit 2018.

Let's personalize your content