Toyota’s tax credit advantage over competitors like Tesla disappears

Teslarati

JULY 4, 2022

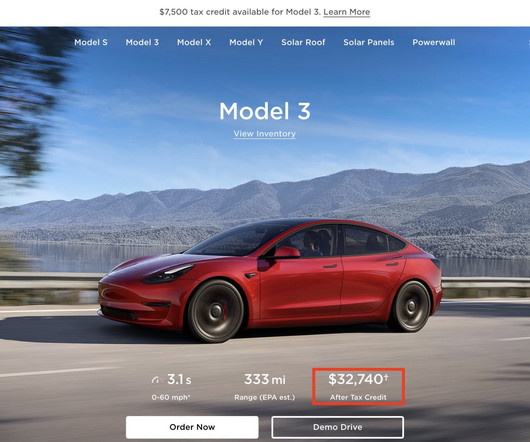

The road ahead for Toyota as it starts competing seriously in the all-electric market just got a lot tougher. As recently corroborated by the veteran Japanese carmaker, it has already crossed the 200,000-unit cap for the United States’ $7,500 tax credit for hybrid and all-electric vehicles.

Let's personalize your content