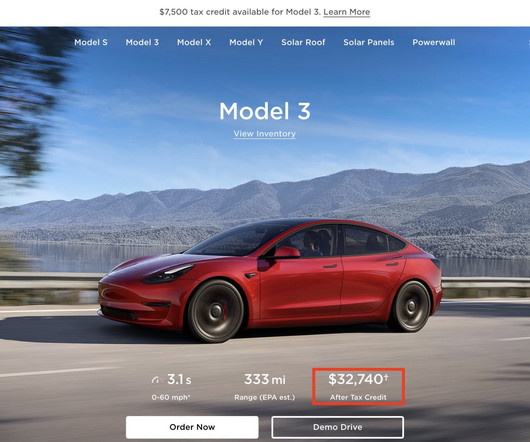

New Tesla Model 3 Performance with federal tax credit is more affordable than Long Range AWD

Teslarati

APRIL 24, 2024

This is because among Tesla’s current Model 3 lineup, only the new Model 3 Performance qualifies for the $7,500 federal tax credit. With the federal tax credit and estimated gas savings in place, the upgraded Model 3 Performance becomes more affordable than the mid-tier Model 3 Long Range Dual Motor AWD variant.

Let's personalize your content