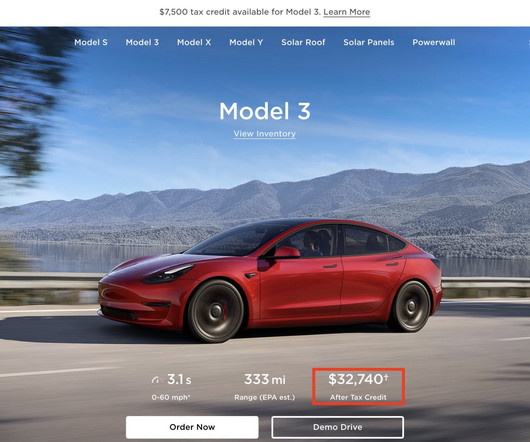

Tesla starts applying EV tax credit at time of purchase

Baua Electric

JANUARY 17, 2024

Fewer Tesla EVs now qualify for the $7,500 federal EV tax credit, but for those that do, Tesla is now applying the credit at the time of purchase. The automaker’s website now says that eligible buyers will have the full $7,500 credit applied when they purchase their vehicles.

Let's personalize your content