Almost all electric vehicles would qualify for the US EV tax credit with new Congress bill

Electrek

NOVEMBER 7, 2022

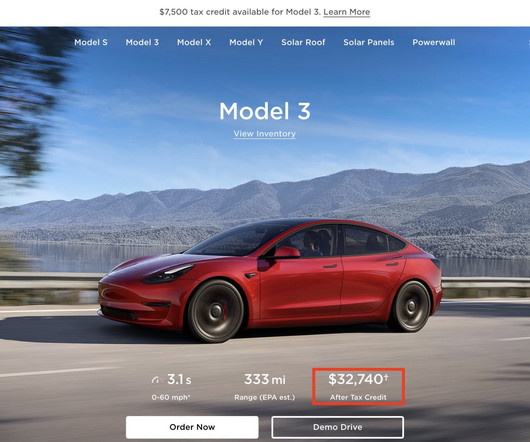

You may be in luck if you’re looking to buy an electric vehicle. A new bill introduced in the Senate called the Affordable Electric Vehicles for America Act would allow essentially all EVs in the US to qualify for the $7,500 tax credit if passed.

Let's personalize your content