EIA: California home to almost half of US plug-in electric vehicles

Green Car Congress

DECEMBER 10, 2014

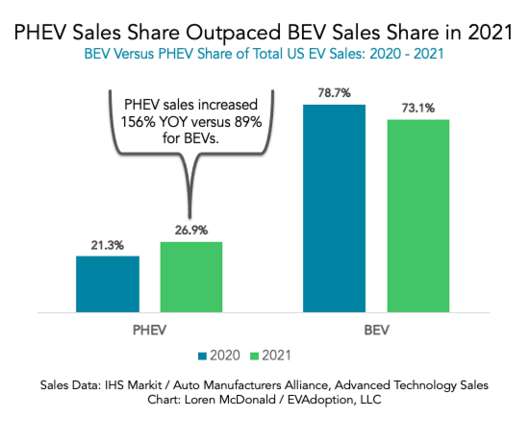

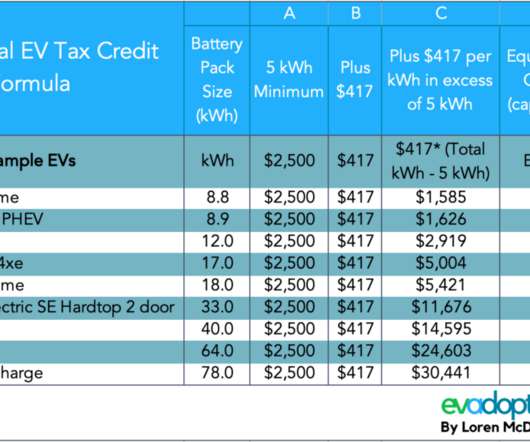

Total US sales of plug-in electric vehicles (PEVs)—battery electric and plug-in hybrid electric—have increased in recent years, but still represent only about 0.7% Several states offer tax incentives to reduce the upfront cost of PEVs to consumers. sales and use tax. in 2013 and 0.4%

Let's personalize your content