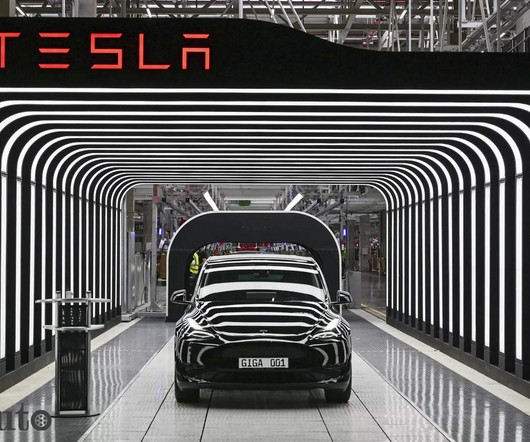

Tesla embraces new immediate EV tax credit system

Teslarati

JANUARY 12, 2024

Tesla has embraced the new immediate use of the EV tax credit, which was announced last year by the IRS and Department of the Treasury. In October , the IRS and Department of the Treasury announced that it would issue new guidance regarding the EV tax credit, with the changes taking effect in 2024.

Let's personalize your content