Tesla models eligible for IRA tax credits in 2024

Teslarati

JANUARY 2, 2024

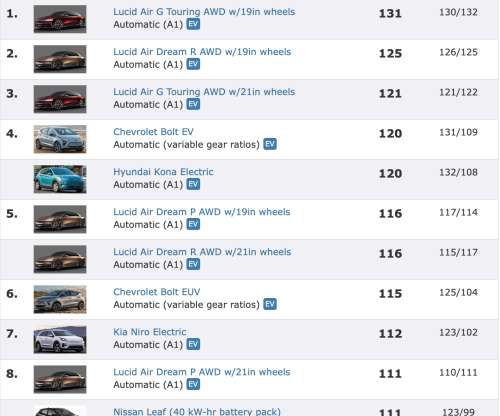

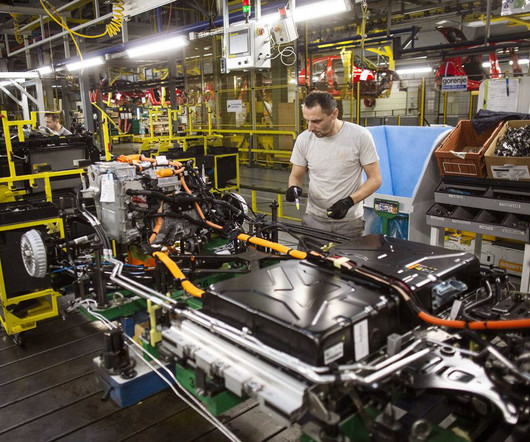

As everyone greets the new year, Tesla updated its website according to the Inflation Reduction Act’s (IRA) requirements for the electric vehicle (EV) tax credits. Most of Tesla’s other models—including the Model X—are eligible for the full tax incentives. The Teslarati team would appreciate hearing from you.

Let's personalize your content