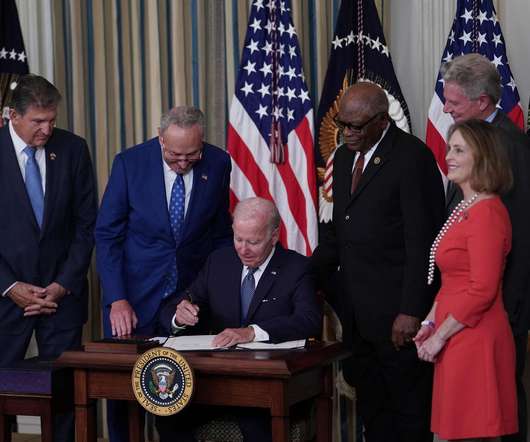

Tesla Semi will be incredibly affordable with US’ revamped EV tax credit

Teslarati

JULY 29, 2022

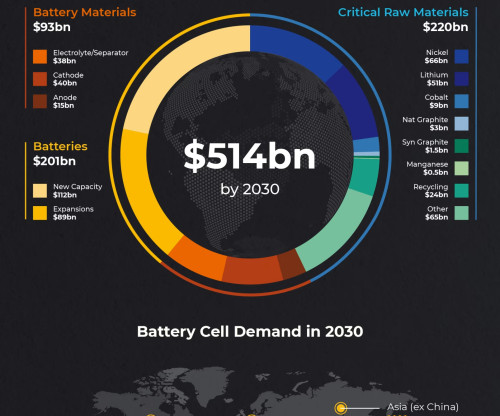

Long-range all-electric trucks like the Tesla Semi will not come cheap. Battery costs are declining quickly, but even Tesla still lists its 300-mile Semi variant with an estimated starting price of $150,000. Interestingly enough, some states already have generous incentives for battery-electric Class 8 trucks.

Let's personalize your content