kWh Billing and New EV Charging Tax Policies: What You Need to Know

Blink Charging

OCTOBER 6, 2023

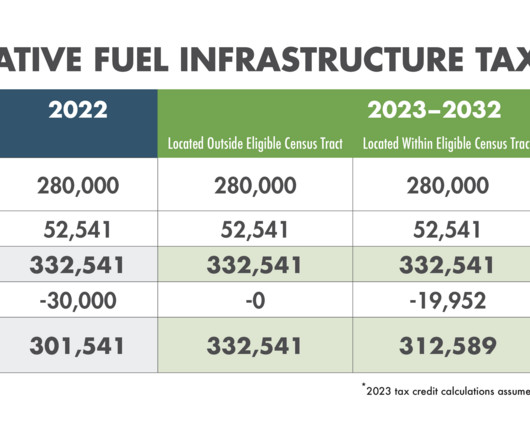

As both EV adoption increases and internal combustion engine vehicles have become more fuel efficient, states are seeking to offset lost revenue from the gas tax. With states enacting new kWh taxes on EVs and EV charging, we want to make sure you have the right information. kWh tax begins on July 1, 2025.

Let's personalize your content