Report: Toyota To Build Subaru Three-Row EV in Kentucky

The Truth About Cars

AUGUST 2, 2023

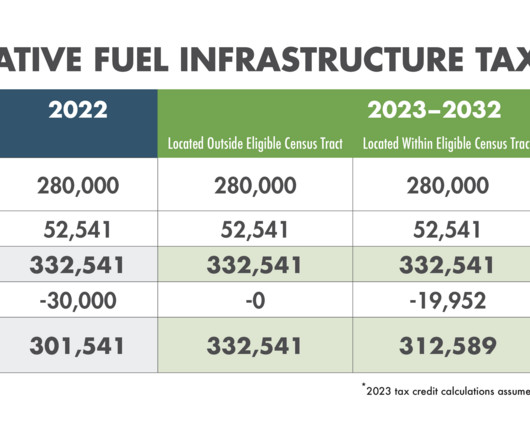

federal tax credits because they’re both built in Japan, making moving EV production to a domestic location the most logical next step for both. Several other automakers are considering or are in process with similar plans to meet the tax credit requirements. Neither automaker’s current EVs are eligible for U.S.

Let's personalize your content