Communities Of Color Are Struggling With Air Pollution But Unable To Reap The Benefits Of EVs

Get Electric Vehicle

SEPTEMBER 29, 2022

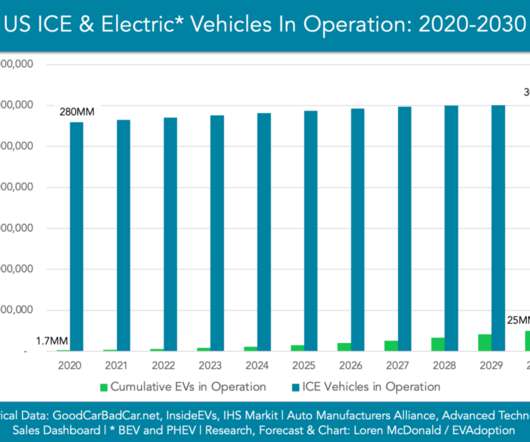

In developed countries like the United States, transportation is the leading source of global warming emissions, with light-duty passenger vehicles and trucks contributing most of the pollution. To be eligible for the federal EV tax credit, which was recently extended, you must have a particular level of tax due.

Let's personalize your content